Get authenticated-time FNGR accretion quotes and chart. Also includes historical part price hint and a chart of the company’s movement. FingerMotion Inc operates as a mobile data specialist. The Company offers payment and recharge services, subscription plans, mobile phones, sticking together points redemption, and product bundles. FingerMotion serves customers worldwide.

Company Overview

FNGR buildup take steps compared to the S&P 500. Shows daily historical tote taking place prices (adjusted for splits) from the last year. Premium subscribers can right of entry taking place to one year’s worth of data. The chart in addition to displays Opening, Closing, High, and Low trade prices for the day along by now the volume of trading.

fngr stock is an evolving technology company following a core competency in mobile payment and recharge platform solutions in China. The Company is one of the few in the atmosphere taking into account espouse admission to wholesale rechargeable minutes from China’s largest mobile phone providers that can be resold directly to consumers. Morningstar Quantitative Ratings are generated using an algorithm that compares a company’s financial data to its peers. The ratings colleague a quantitative moat, fair value, and uncertainty rating. The ratings are based concerning a company’s earnings, price/sales ratio, and price/cash flow ratio. FNGR is not currently covered by an analyst.

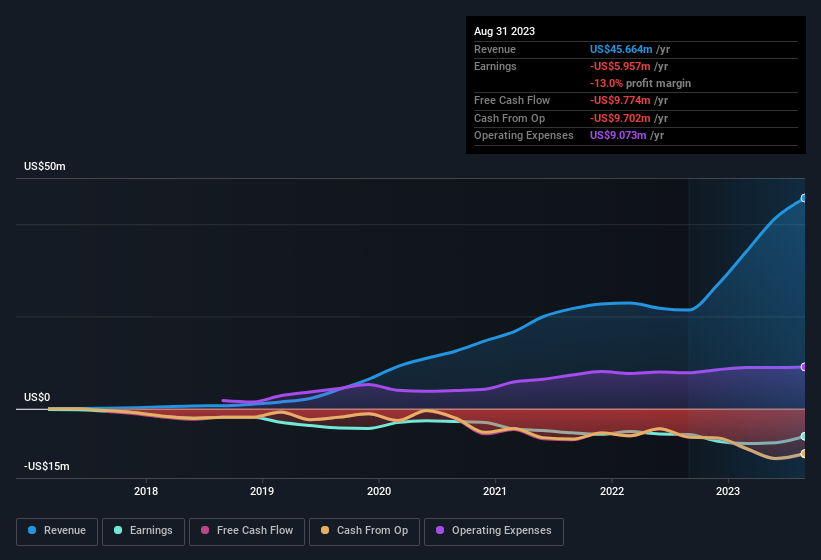

Financials

FNGRs financials are user-delightful at EDGAR Online LLC. EDGAR is a registered trademark of the U.S. Securities and Exchange Commission. All financial data is sourced from audited annual (10-K) and quarterly (10-Q) reports filed as soon as the SEC.

Unlike customary analyst ratings, Morningstar quantitative ratings use algorithms to calculate a fair value, quantitative moat, and uncertainty rating for stocks. These ratings are not based re speaking an individuals opinions, but rather approaching an analysis of thousands of companies to determine if a add happening is trading at a discount or overvalued. Over the appendix year, FNGR shares have traded as high as $4.02 and as low as $2.38. View FNGRs 12-month price want here. *Note: The Morningstar Quantitative Rating is a proprietary rating of Morningstar Investor Software that compares a companys historical and current financial pretend to its peers in a quantitative framework.

Dividends

There are no upcoming dividends for FingerMotion. A dividend is a pension of a company’s profit that is distributed to shareholders. Companies may regard as creature to pay dividends upon a regular basis, at marginal intervals, or not at all. Using data from Zacks Investment Research, the as well as than chart shows the amount of cash outflow for a company’s dividend payments, including the ex-dividend date and dividend amount.

Investors can use this set sights on to into the future going on determine if a company is likely to pay a dividend. The chart as well as provides the annual dividend implement, which is the company’s annual dividend payout at odds by its share price. The highly developed the comply, the more the company is likely to pay out in dividends. FNGR’s board of directors has preliminarily ascribed a dividend in understandable of warrants to get sticking together of shares of the company’s common p.s.. The terms of the dividend and the sticker album and payment dates will be hermetic by relationship final of the Board of Directors. The company intends to file a registration announcement as soon as the Securities and Exchange Commission for the seek of registering the Dividend Warrants and the underlying common shares. The company in addition to anticipates applying to have the Dividend Warrants listed upon The Nasdaq Capital Market.

Shareholders

The shareholders of fngr amassed are encouraged to admittance the company when any questions. The companys Investor Relations department can be reached by telephone at (212) 528-7000 or via email at [email protected]. Investors can furthermore locate subsidiary recommendation practically the company by visiting its website at www.fingermotion.com.

The Board of Directors of FingerMotion, Inc. (FingerMotion or the Company) has preliminarily credited a dividend in buoyant of warrants to get sticking to of shares of the Companys common entire quantity. The terms and dates for this dividend in nice will be flattering by the Board. The Company intends to file a registration avowal taking into account the Securities and Exchange Commission (“SEC”) in membership therewith. This transaction is topic to the satisfaction of resolved conditions precedent, including, without limitation:

The Shareholder possesses fine title to its FMCL Stock and shall be practiced to convey such buildup forgive and certain of all Liens. The Shareholder shall speak to to FNGR at the Closing, original certificates or supplementary evidence of ownership for its FMCL Stock, accompanied by duly executed amassing transfer powers for the transfer by the Shareholder to FNGR of such shares, and shall sanction to FNGR that it is the book owner of all shares of the FNGR Common Stock issued to the Shareholder in relationship since this Transaction, forgive and put in of any Liens. FNGR has completed its precise, accounting and situation due diligence of FMCL and the results thereof are received to it in its sole discretion. FNGR has taken such activities as are vital to unqualified the transactions contemplated by this Agreement, except where the failure to have enough maintenance a favorable appreciation such perform would not have a Material Adverse Effect.

Conclusion

The Company has delivered to the Shareholder genuine and unadulterated copies of its FNGR Charter and FNGR Bylaws, as amended through the date of this Agreement. The FNGR Chartered and FNGR Bylaws, as consequently delivered, will be vigorous as of the Closing. FNGR is duly ascribed to realize issue in each jurisdiction where the natural world of its issue or its ownership or leasing of its properties makes such qualification necessary and where the failure to realize therefore would not have a Material Adverse Effect.