Shopify has become one of the most popular e-commerce platforms in recent years, with a market capitalization of over $200 billion as of April 2023. The company’s stock has seen tremendous growth over the past few years, but is it still a good investment? In this article, we’ll take a closer look at Shopify’s financial performance, industry trends, and growth prospects to determine whether Shopify stock is a good buy in the current market.

Financial Performance

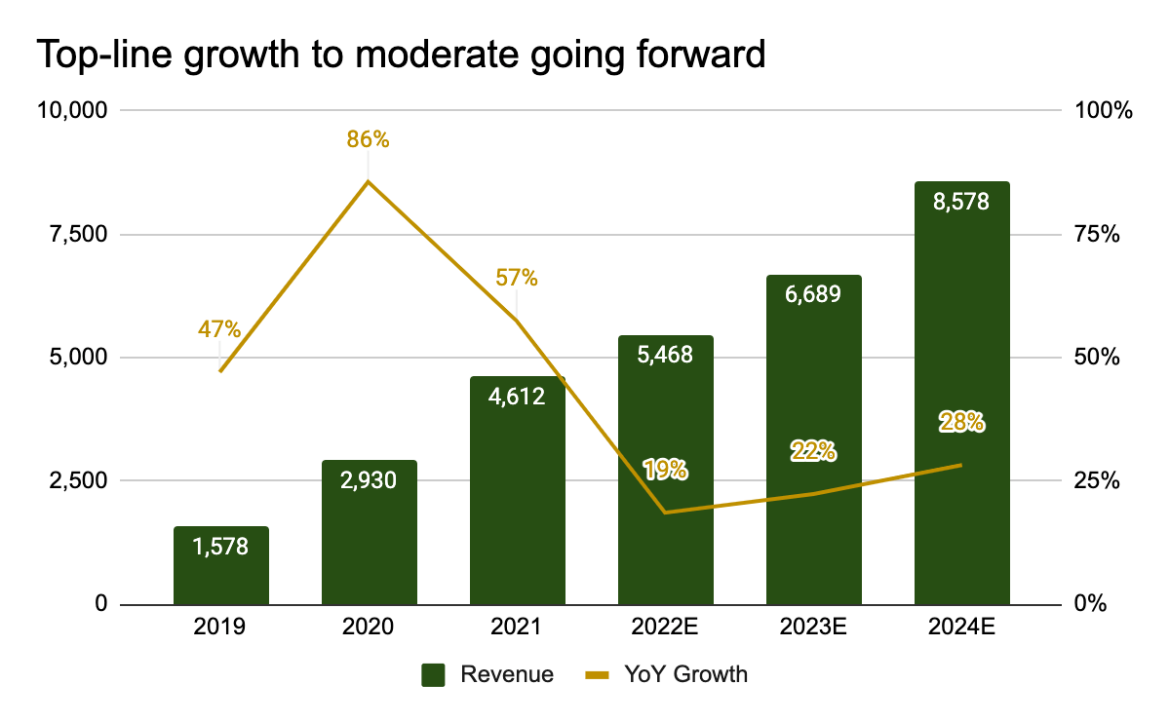

Shopify has been on a remarkable growth trajectory in recent years, with revenue increasing from $673 million in 2018 to $3.2 billion in 2021. The company has also seen a significant increase in gross merchandise volume (GMV), which measures the total value of products sold on the platform. In 2021, Shopify’s GMV increased by 81% year-over-year to reach $170.2 billion.

Despite the company’s strong revenue growth, Shopify has yet to turn a profit. In 2021, the company reported a net loss of $1.1 billion, up from $124.8 million in 2020. However, it’s worth noting that the company has been investing heavily in its growth, with significant spending on research and development, sales and marketing, and general and administrative expenses.

Industry Trends

The e-commerce industry has been rapidly growing in recent years, and the COVID-19 pandemic has only accelerated this trend. According to eMarketer, global e-commerce sales are expected to reach $5.4 trillion in 2022, up from $4.2 trillion in 2020.

Shopify is well-positioned to benefit from this trend, as more businesses shift their operations online. The company’s platform allows merchants to quickly and easily set up an online store, manage inventory, process payments, and more. Shopify has also been expanding its offerings to include more features, such as point-of-sale systems and fulfillment services.

Competition is also a key factor to consider in the e-commerce industry. Shopify’s main competitors include Amazon, WooCommerce, and Magento, among others. While Amazon is the dominant player in the space, Shopify has been able to carve out a niche by focusing on small and medium-sized businesses.

Growth Prospects

Looking ahead, Shopify’s growth prospects appear strong. The company has continued to add new merchants to its platform at a rapid pace, with over 2 million merchants using Shopify as of 2021. The company has also been expanding its international presence, with significant growth in markets such as Asia-Pacific and Europe.

Shopify’s expansion into new areas such as point-of-sale systems and fulfillment services also presents an opportunity for the company to continue to grow. Additionally, the company has been investing in its technology and infrastructure, with the goal of improving the platform’s scalability and reliability.

However, there are also some potential risks to consider when evaluating Shopify’s growth prospects. One risk is the potential for increased competition in the e-commerce space, particularly from larger players such as Amazon. Additionally, Shopify’s growth has been heavily reliant on the success of its merchants, and any significant downturn in the small business sector could have a negative impact on the company’s revenue.

Conclusion

Overall, Shopify has been a strong performer in the e-commerce industry, with impressive revenue growth and a large and growing user base. While the company has yet to turn a profit, its heavy investment in growth and expansion makes this less concerning in the short term.

Looking ahead, Shopify’s growth prospects appear strong, as more businesses shift their operations online and the company continues to expand its offerings and international presence. However, investors should also consider the potential risks associated with increased competition and reliance on the success of its merchants.